Contents

Many people don’t realize that using your debit card in foreign countries can cost you a lot of money. That is, if you have the wrong debit card. Many still have debit cards that incur transaction fees, currency conversion fees, and so on, which can leave you with a nasty surprise during your vacation. Especially, when you receive an alert about having a low balance despite thinking you had a lot more money in your account. Don’t worry we will show you the best debit cards to use with no fees, when you visit Bali.

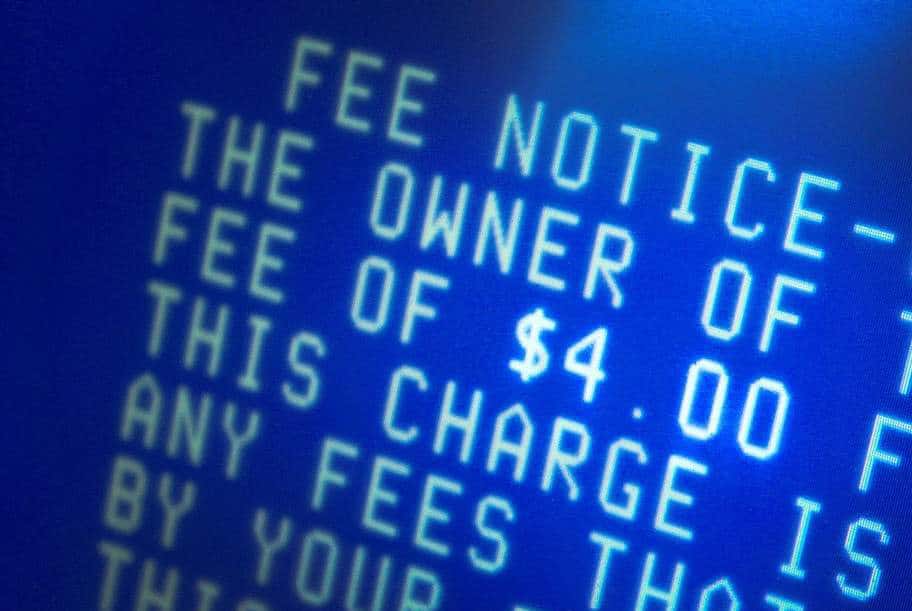

When using the ATMs you will often incur bank fees. Many ATMs charge a fee, then your card issuing bank will charge you a fee for not using their ATM. It adds up very quick. However, there are some cards that will help you avoid all these fees, when trying to withdraw money in Bali or while traveling abroad.

Below are my favorite cards to use when traveling to Bali, and other countries. They do not have any foreign transaction fees. So you can use the ATM’s without fees, which means you can withdraw local currency for free, when you visit Bali. They also have very nice security features that help prevent fraud and card skimming.

Read this article on How to Spot an Unsafe ATM and Check for Skimmers Using Your Phone.

What Debit Card Should I Use in Bali?

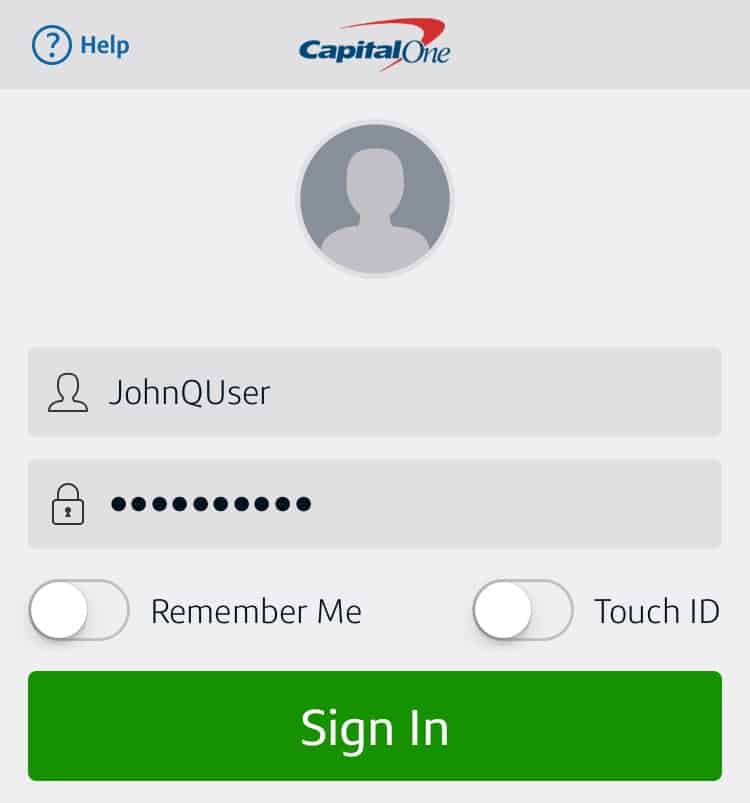

Capital One 360

My favorite debit card to use when visiting Bali, is the Capital One 360 debit card that comes with opening the Capital One 360 online bank account. First, because this card has no ATM fees. This means I can withdraw money at my preferred ATM, and Capital One will not charge me any fees. I can use various banks in Bali and they will not charge me a bank fee to use the ATM. Therefore, I can withdraw money free of charge! This will save you a lot of money in bank fees each time you have to withdraw cash.

TIP: I prefer to use Mandiri Bank ATMs in Bali, because I can withdraw money free of charge when using my Capital One 360 debit card.

The Capital One 360 debit card is also my preferred card for the following reasons:

- Easily able to create a 360 checking account online in minutes.

- During account set up I was able to fund the account by linking my preferred bank account.

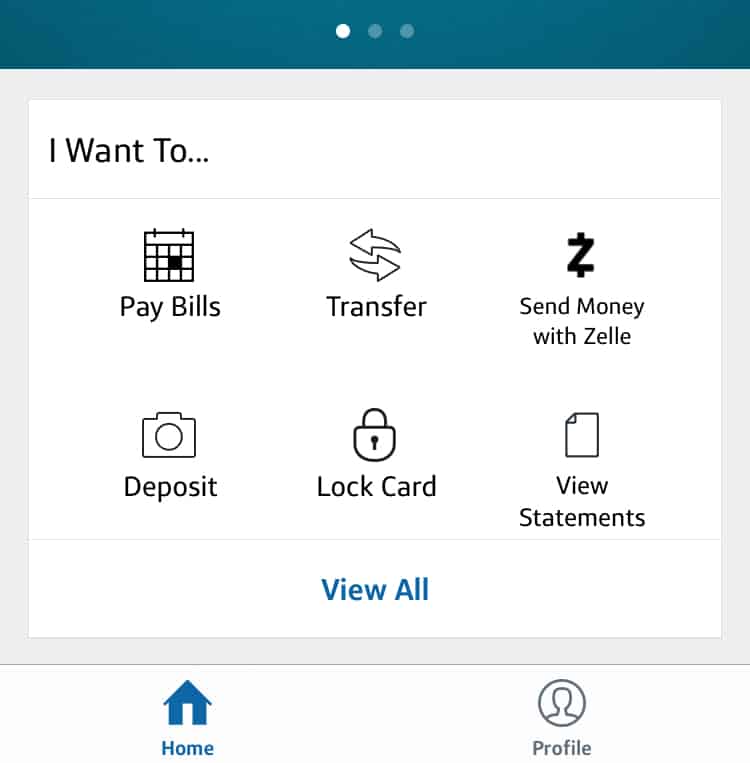

- I can easily transfer money to this account using the “Transfer” option, or instantly using Zelle.

- Capital One 360 is a MasterCard branded card which means I don’t have as many problems vs. using a VISA branded card in Bali.

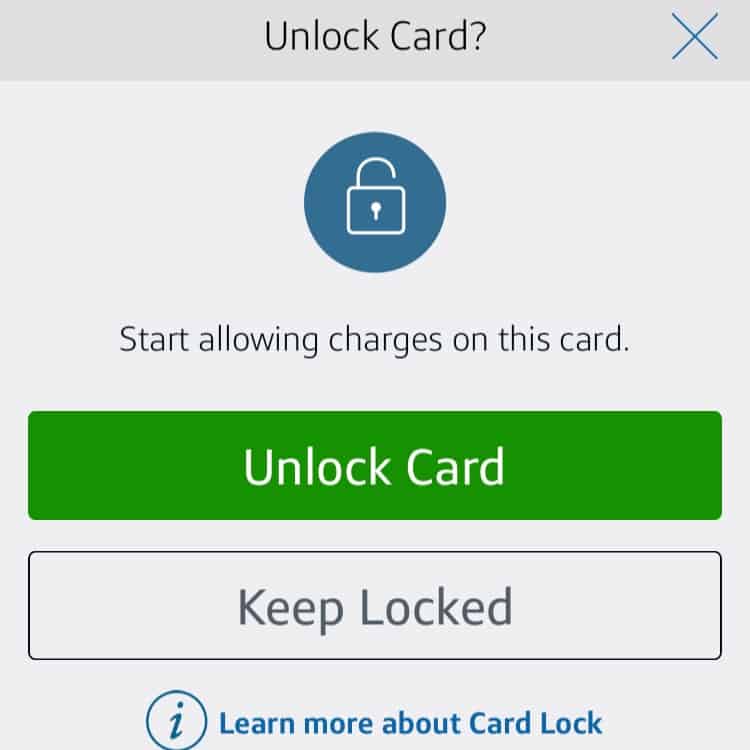

- The Capital One app allows you to easily “lock” and “unlock” your card to prevent fraudulent use.

- $1000 USD daily withdrawal limit at ATMs. This is more than enough money in Bali for daily spending, and I withdraw this amount with zero fees.

I really recommend to anyone wanting to visit Bali that they open a Capital One 360 account and use it to withdraw money in Bali at the ATMs. This is beneficial for a number of reasons.

- You can use most ATMs without any problems because most ATMs in Bali prefer MasterCard.

- The current exchange rate you see online is extremely close to what you will get when withdrawing money. Similar to doing the exchange calculation with a money exchanger.

- You can “lock” and “unlock” your debit card using the Capital One app. This requires an extra minute to “unlock” your debit card before using the ATM, but it is worth it. For instance, locking your debit card at all times, other than while using it at the ATM, means no one can use your card for purchases, or ATM withdrawals, if lost or stolen. Also, if your card ever gets “skimmed”, the person who skimmed your card will probably end up discarding your information because they can’t use it.

- Having this card is a good alternative to using the bank account where you may keep most of your money, or pay bills from. You can simply transfer what you need to your Capital One account and use as needed. You are limiting your exposure, so to speak, in case your debit card is ever compromised, or you lose it.

- Capital One is partners with Zelle, so you have the option of making instant transfers from other bank accounts, such as Chase Bank.

Open your Capital One 360 Checking Account here.

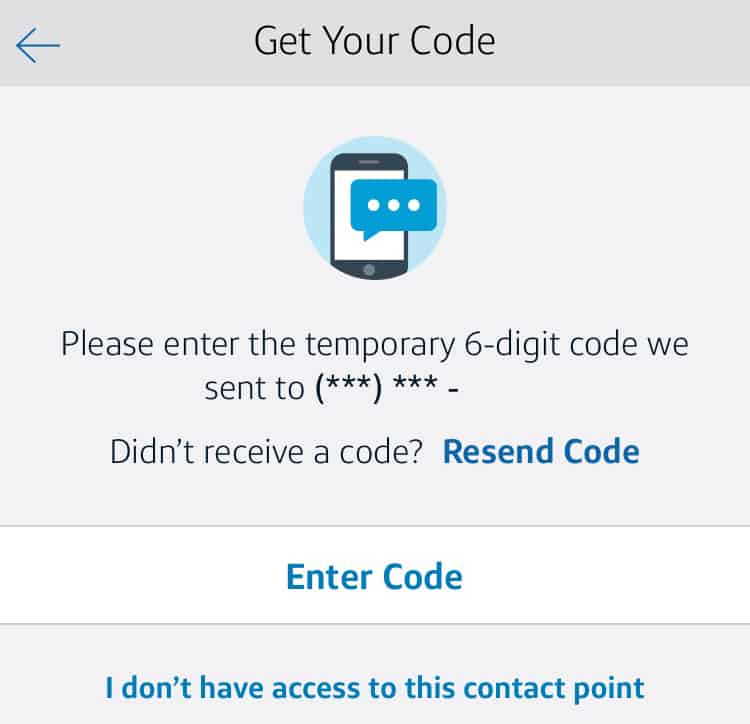

TIP: Set up the secondary security feature on your account. This means that when you log in Capital One will send you a code to enter before giving you access to your account.

Read this article on “How to Use ATM’s in Bali”. Also, you want to read “How to Spot an Unsafe ATM and Check for Skimmers Using Your Phone.”

Schwab Bank

My next favorite account and debit card to withdraw money in Bali is the Schwab Bank High Yield Investor Checking Account. Don’t worry, it sounds like an account you need to keep a lot of money in, but they have no account minimums and, like the Capital One 360 account, is completely free.

This account also has no ATM fees. If another bank charges you an ATM fee, Schwab will refund that amount to you. You also have the ability to “Lock” and “Unlock” the debit card that comes with this account. It took Schwab a little while to introduce this feature, but it is now available and very nice to have.

TIP: Lock your debit card when you aren’t using it. This prevents someone else from using your card if lost, stolen, or skimmed.

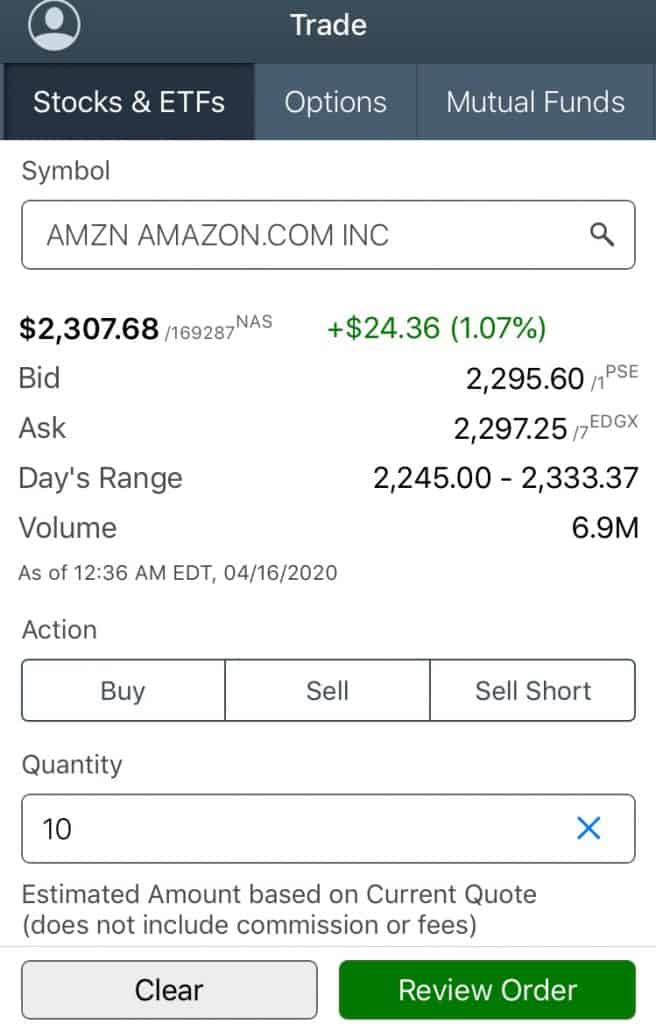

I really recommend having this account as it is also linked to a brokerage account. Therefore, you can use the Schwab platform to make investments, either online or through the app. I use the Schwab account as one of my main bank accounts, and having no account fees, regardless of your account balance, is really nice.

However, when traveling there are two very minor problems, in my opinion, associated with this account and debit card.

- The Schwab debit card that is issued is Visa branded. As mentioned previously, a Visa branded debit card can cause you some problems here in Bali when using the ATM.

- Schwab does not offer the option to make transfers using Zelle, at the moment. Therefore, this means that if you are trying to transfer money to, or from, your Schwab account it will take a few business days to complete.

Open your Schwab Bank High Yield Investor Checking Account here.

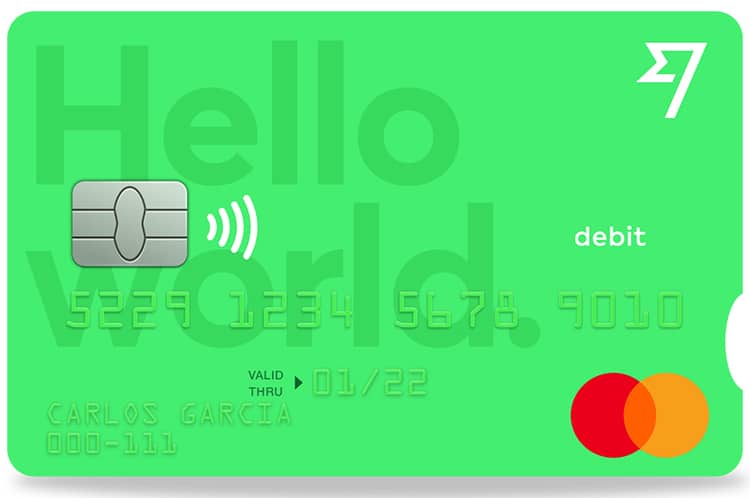

TransferWise

TransferWise is a really good travel debit card as well. The Borderless account is a free account, just like the Capital One 360 and Schwab accounts, but you can hold more than 50 different currencies at once. For instance, when you visit Bali, you can transfer money from your home country currency to Indonesian Rupiah, and then use your debit card to spend that money without fees.

For instance, let’s say you are in Bali and have left your hotel, but don’t have cash. Maybe you are out to dinner, or at the store. Using TransferWise you can transfer money from USD to IDR and then make a purchase using your MasterCard branded debit card. The purchase is made using local currency, automatically, and without any extra fees.

Also, when using the ATM you can withdraw local currency without conversion fees or bank fees. Within the TransferWise app, or online, simply transfer money from your home country currency to a foreign currency. Then go to the ATM and withdraw your foreign currency without any fees.

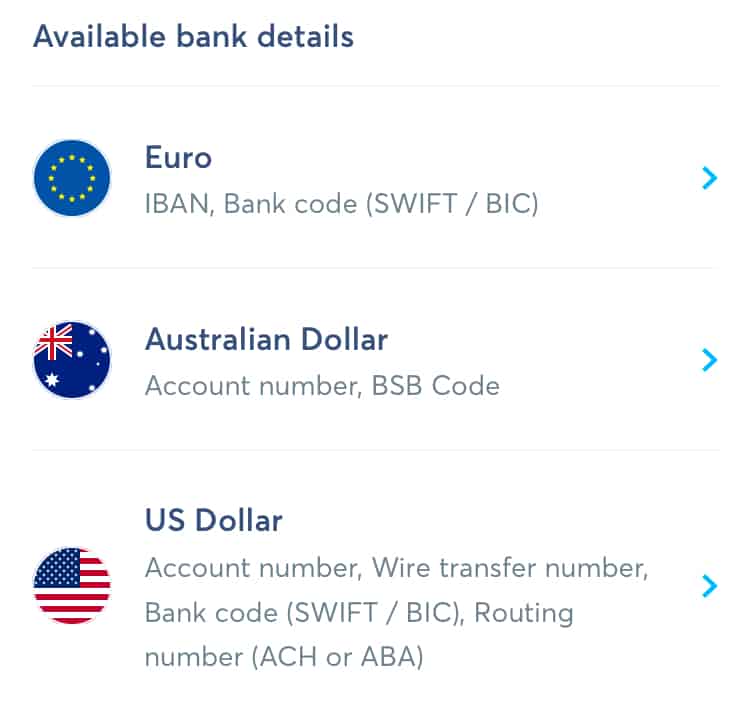

In addition, when you open a Borderless account you can get “local” banking information from the U.K., U.S.A., Australia, New Zealand and a European IBAN for free. This could come in handy for those of you who are digital nomads.

At the end of your trip you also don’t have to worry about having leftover foreign currency. If you have extra rupiah in your account, that you were using as money for Bali, simply transfer it to the next currency you want to use at the best exchange rate. Its comparable to what you would see on Google, or in your XE Currency app.

TIP: Download the XE Currency app for your phone. It gives updated currency rates every minute. This comes in handy when wanting to exchange money, or use the ATM. I use my app all the time.

Like the Capital One and Schwab accounts, you can also “Freeze” your TransferWise account. It is a nice security feature to have to prevent unauthorized use. Just remember, you will have to “Unfreeze” your account before using it at ATMs and to make purchases.

This account does have some limitations though.

- For someone like me, who lives in Bali, it is not always a good debit card to use for all of my ATM withdrawal needs. You can only withdraw up to $250 each month, without fees. If you need to withdraw more money you will be charged 2% withdrawal fee.

- Also, if you have a credit card with no foreign transaction fees, the calculated exchange rate for each transaction, can be slightly lower than the currency conversion fees charged by TransferWise. I’m really getting down to cents here, literally, for these smaller transactions. So this certainly isn’t a deal breaker.

- If you live outside the U.S.A., Europe, Australia, New Zealand, or Singapore, at the moment you are unable to receive a TransferWise debit card.

Open your Transferwise Money Without Borders account here.

Conclusion

When traveling you need to be smart about how to use money in Bali, and other foreign countries. This is because you can end up spending a lot more, after incurring fees, if you are not using the right account and debit card. No account is perfect, in my opinion. But having all of these accounts pretty much makes it the perfect solution to being able to obtain and use cash, fee free, in any country.